Ads keep our service free · We don't endorse advertised products.

Ads keep our service free · We don't endorse advertised products.

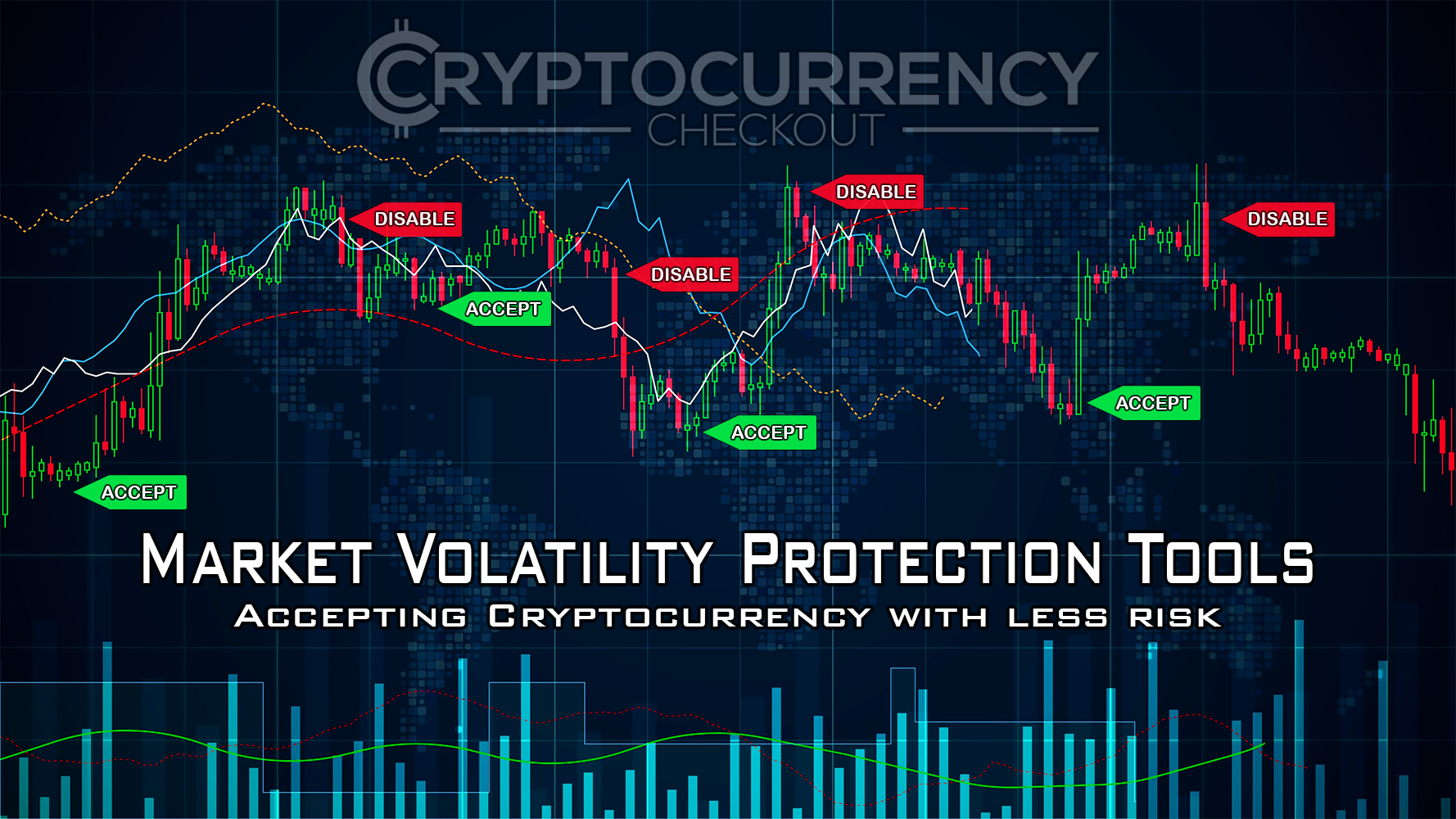

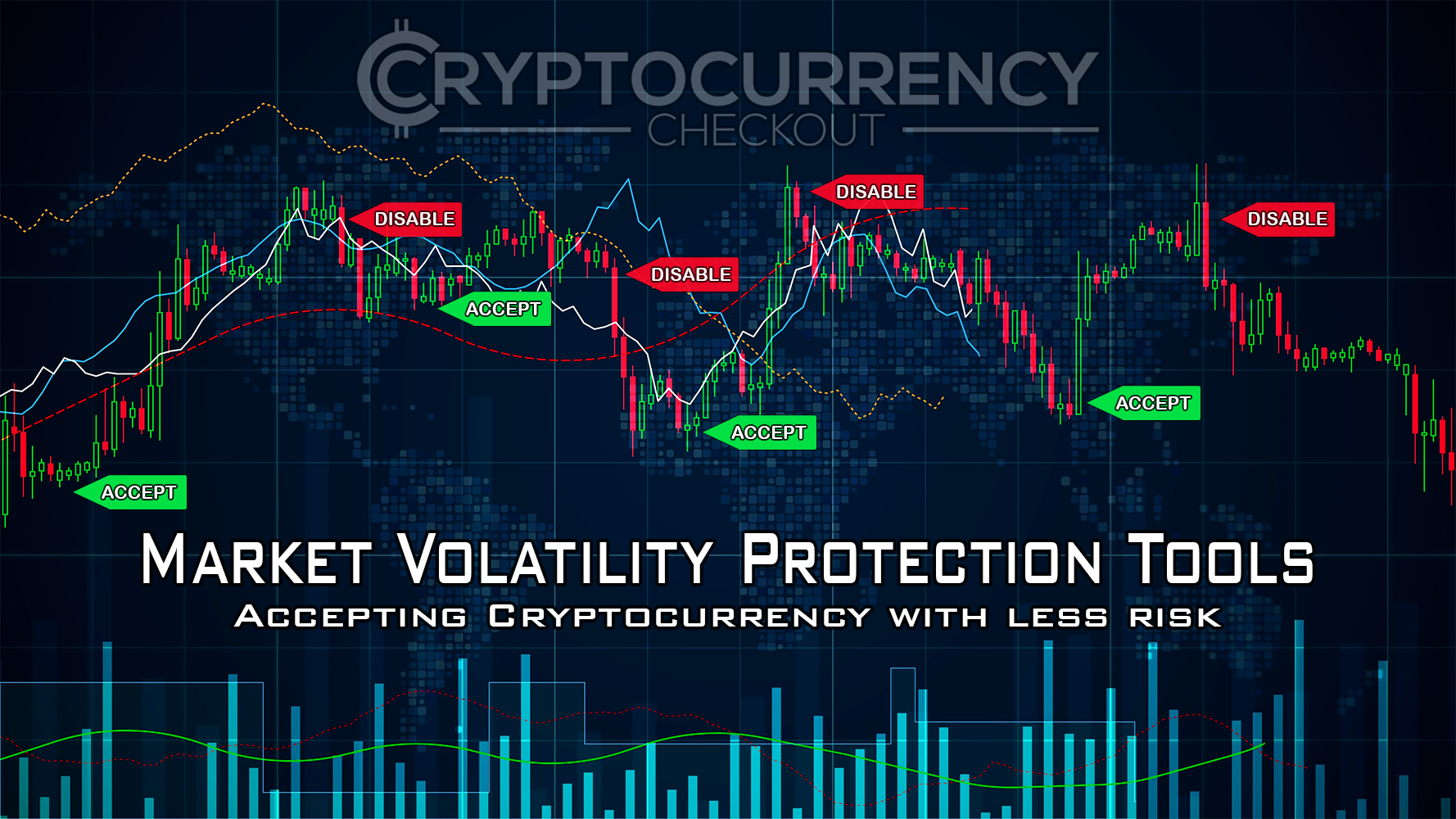

Cryptocurrency Market Volatility Protection Tools (Beta)

Ads keep our service free · We don't endorse advertised products.

Ads keep our service free · We don't endorse advertised products.

When accepting cryptocurrencies like Bitcoin or altcoins for goods and services, one of the primary concerns for online merchants is market volatility.

Merchants want to avoid holding depreciating assets during a flash crash or facing low liquidity when attempting to convert crypto to fiat currencies (like USD, EUR, or GBP). Low buyer interest could leave a store stuck with a cryptocurrency that must be sold at a significant loss, or cannot be sold at all.

This is especially concerning for volatile altcoins that experience severe week-to-week price fluctuations.

To help mitigate excessive market volatility, we have introduced the Market Volatility Protection Tools (Beta) to the CryptocurrencyCheckout platform.

This feature continuously monitors major cryptocurrency exchanges, tracking metrics such as:

We aggregate and average prices, volume, and volatility data across numerous platforms. Notable exchanges include:

Configuring maximum allowable price fluctuations

Applying markups for specific cryptocurrencies

Setting minimum daily trading volume requirements

Combining multiple parameters for custom risk management

By configuring the maximum daily percentage drop you are willing to tolerate, our platform will automatically disable specific cryptocurrency payment methods if their price falls below your defined threshold.

For example, if you accept Dash and set a maximum daily price drop of 5%, a sudden 7% crash will trigger the platform to disable Dash payments. Customers will be prompted to use a more stable payment method or wait for the price to recover.

This feature prevents customers from offloading rapidly depreciating assets onto your store during a market downturn.

If you want to broaden your customer base by accepting more altcoins but are concerned about their volatility, you can mitigate this risk by applying a markup at checkout.

For instance, if you consider Dash more volatile than Bitcoin, you can configure a 2% surcharge for customers opting to pay with Dash.

Conversely, you can incentivize the use of preferred, stable cryptocurrencies by offering a customized discount at checkout.

We recommend keeping these adjustments reasonable. Our platform displays these markups and discounts transparently, and excessive fees may lead to cart abandonment.

This feature allows you to require a minimum daily trading volume across top exchanges before accepting a specific cryptocurrency.

Daily trading volume is a reliable liquidity indicator, ensuring there is sufficient market demand for you to safely convert received crypto into fiat.

For example, if you receive $100 in Dash and the network's daily trading volume exceeds $500,000, market liquidity is high enough to process your conversion seamlessly.

However, if an altcoin's daily volume drops to just a few thousand dollars, low buyer interest could make it difficult and time-consuming to liquidate those assets without taking a loss.

By configuring a volume threshold, our system automatically toggles payment options based on real-time network liquidity.

Ads keep our service free · We don't endorse advertised products.

Ads keep our service free · We don't endorse advertised products.

By combining price fluctuation limits, volume requirements, and targeted markups, you can build a robust risk management strategy for accepting cryptocurrency payments.

If our system detects a daily price drop exceeding your 2% threshold, it automatically disables that specific cryptocurrency at checkout until its market value stabilizes.

If global trading volume falls below your $500,000 threshold, the platform suspends the coin as a payment option, preventing you from acquiring illiquid assets.

If a market-wide crash triggers the allowable price drop threshold for all your accepted assets, the system disables cryptocurrency checkouts globally and prompts customers to use alternative payment methods.

You can configure these protection tools within the Connection Setup area of your CryptocurrencyCheckout Dashboard.

To learn how to start accepting cryptocurrencies on your website or store, check out our CryptocurrencyCheckout Installation Guides.

If you experience any issues, please send us a message or join our Discord community.

Accepting cryptocurrency can significantly expand your customer base and improve profit margins. However, digital assets carry inherent risks. Always perform due diligence and execute a robust risk management strategy when receiving, holding, or converting cryptocurrencies.

Ads keep our service free · We don't endorse advertised products.

Ads keep our service free · We don't endorse advertised products.